- Offered listings got to 1.38 million, up 23.3% year over year, +7.0% vs. 2019

- Overall demand increased 19.8% YOY, and is up 16.4% vs. the pre-pandemic 2019 baseline

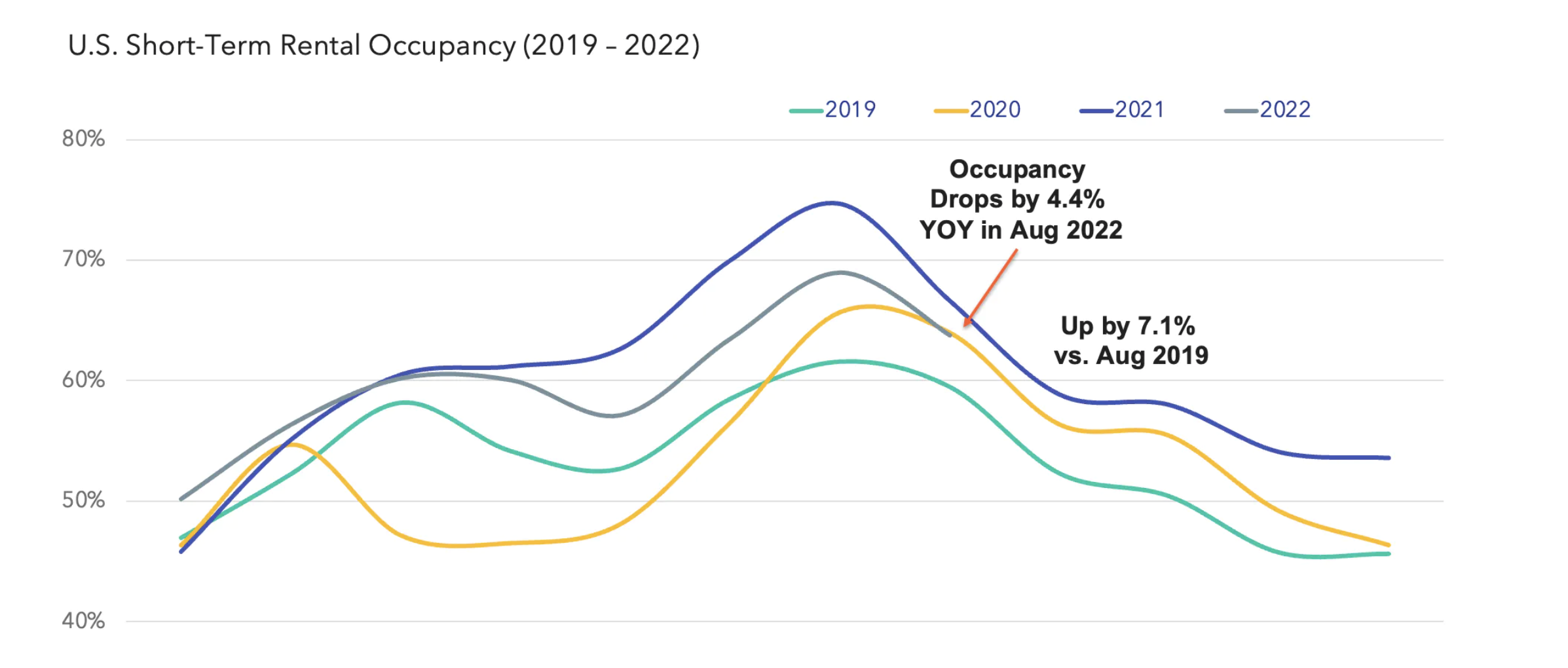

- Occupancy decreased 4.3% YOY to 63.8%; Tenancy is up +7.1% vs. 2019

- Average everyday rates (ADRs) increased 2.8% YOY to $288, and are up 22.8% vs. 2019

- Total amount Income was 23.1% higher YOY in August, and is up 42.9% vs. 2019

- Nights booked for future travel were up 16.9% YOY to 17.7 million

During August, temporary rental sector performance continued to be durable, continuing the well-established trend of both the summer and also 2022 all at once. Over 20.7 million evenings were stayed throughout short-term services, down from July's top of 23 million as several colleges reopened and the household holiday group was somewhat much less active in the U.S. market.

Need for the month was up 19.8% year-over-year, expanding from the +17.8% year-over-year analysis seen in July. In 2021, worries concerning the Delta variation dampened traveling need during the summertime, but overall travel spending in the United States this summer season is approximated to hit brand-new records, notably passing 2019's pre-pandemic degrees.

While typical daily rates continue to climb, both year-over-year as well as versus 2019 levels, a sharp rise in supply of available listings (up 23.3% YoY in August) remains a common theme in 2022. During August supply development outpaced need development, bring about the sixth month in a row of decreasing occupancy prices with a -4.3% analysis throughout August.

Economic Unpredictability Continues

As a result of the supply raises, hosts have actually encountered an uphill battle in the effort to cover costs with high inflation, currently tracking above 8% in the U.S. according to the August Consumer Price Index (CPI). ADRs were up a scant 2.8% year over year in August, adhering to a 3.8% ADR increase in July. The addition of even more listings nationwide, rising labor costs and the relentless inflation will remain to put pressure on income per available listing (RevPAR), which struck document degrees in 2021.

Economists, and also the Federal Reserve (which controls rate of interest), can not seem to agree on the overall instructions and health of the U.S. economic situation, as the expectation continues to be unclear as long as rising cost of living tracks well over historical standards. The labor as well as costs figures continue to be solid, with 315,000 jobs added during the month as well as discretionary consumer spending growing, yet fears of a recession will likely continue to be with the year-end. The most significant X-factor in financial estimates is whether COVID case counts can remain on a descending trend via the holiday and also winter season periods.

Newly-approved vaccinations that are originated from more current COVID-variants can do a lot to relieve anxieties of travel during these vital future months for the STR sector.

Gas prices have fallen by one more 35 cents to $3.70 on average according to AAA, and also need to be a step-by-step boost to travel factors to consider heading into the 4th quarter.

Supply Growth Impacting Tenancy in Many U.S. Markets

The supply of available listings got to 1.38 million in August-- 23.3% higher than the year prior, yet just 7.3% higher than 2019's 1.28 million listings. The gradual relaxation of travel limitations that 2022 has brought has actually created several potential hosts to get in the market, looking to make the most of the solid ADR as well as tenancy figures that 2021 delivered to existing hosts. New listings development started a sharp acceleration in March of this year, with STR listings development of over 70,000 each month for five successive months. A total amount of 76,000 new listings hit the STR market during the month of August.

U.S. Short-Term Rental Supply Strikes Document Degrees in 2022

The amount of brand-new listings are there in your market?

Of the 50 biggest United State short-term rental markets the highest price of growth has

actually taken place primarily in large cities in Texas and the southwest. Houston had the best development in listings, going from 10,950 listings in August 2021 to 16,270 listings in 2022, a 48.6% rise in simply one year. The following fastest growth markets consisted of Phoenix (+45.8%), San Antonio (+44.7%), Las Vegas (+41.4%), as well as Dallas (+39.0%). These bigger cities might be starting to benefit from the return of company travel for conventions and meetings.

YOY modification in offered listings

With the substantial gains in listings, numerous markets saw major declines in average tenancy for the month with Las Vegas seeing the largest decrease of 13% year over year. Just Lakeland/Winter Sanctuary, Florida, had a year-over-year decrease in listings, which helped it attain a 10.2% increase in tenancy over the previous year. Of the 50 largest markets, only 20 accomplished tenancy gains in the month.

Overall U.S. tenancy was at 63.8% throughout August-- going down below both 2020 as well as 2021 degrees. Recalling to 2021's record degree (66.7% last August), huge suppressed demand met a hotel sector that was slow to totally resume, and STR listings development that was still in a pandemic-driven lull.

All area kinds saw a year-over-year decrease in tenancy, varying from a light 1.5% decrease in seaside destinations to a 7.7% decline in midsize cities. Rural markets have been a pocket of toughness throughout the summer, as tourists have shared a desire to obtain closer to nature and take even more journeys to destinations close to hills, rivers, and also national forests.

.png?width=1000&height=627&name=air+concierge-logo-black+(1).png)